In the retail sector, effective payment solutions are crucial. Retailers must balance cost, convenience, and security to meet customer expectations and protect sensitive information.

Showing the Ropes

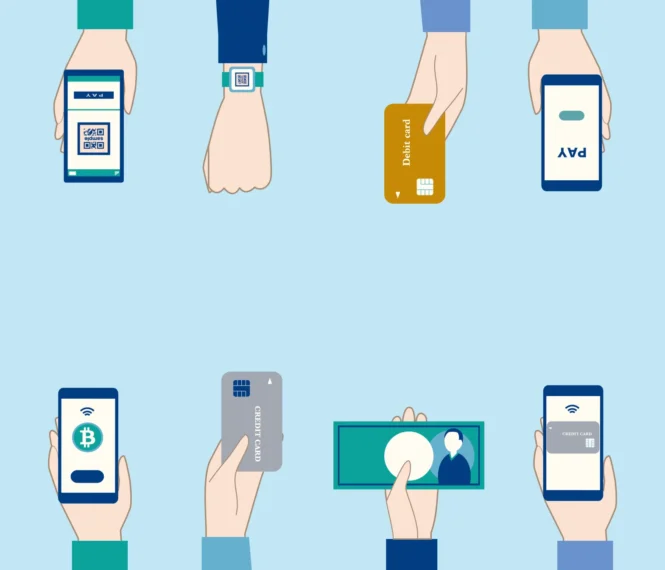

Payment solutions encompass a variety of methods that facilitate transactions between customers and retailers. These include traditional point-of-sale (POS) systems, online payment platforms, mobile wallets, and a virtual terminal. Technology has revolutionized payment systems, making them more efficient and accessible.

Mobile wallets like Apple Pay and Google Wallet, online payment methods such as PayPal, and virtual terminals that allow remote card processing all contribute to this transformation. These solutions not only streamline transactions but also enhance the overall customer experience.

Virtual terminals are particularly beneficial for businesses that operate without physical storefronts, enabling secure and convenient remote transactions. The evolution of payment systems reflects the growing demand for flexible, secure, and user-friendly payment options in the retail industry.

The Importance of Convenience

Convenience in payment solutions is pivotal for customer satisfaction. Streamlining transactions by reducing the number of steps in the checkout process can significantly enhance the shopping experience.

Offering a variety of payment methods, such as credit and debit cards, mobile wallets, digital currencies, and virtual terminals, caters to diverse customer preferences. Quick and seamless payments, peer-to-peer transfers, and efficient cross-border transactions further improve convenience.

A case study on mobile wallet adoption, referencing TrustDecision, highlights how these solutions simplify payments and increase customer satisfaction. For instance, mobile wallets reduce the need for physical cards and cash, allowing customers to complete transactions swiftly using their smartphones.

This level of convenience is essential in today’s fast-paced retail environment, where customers expect quick and hassle-free payment options.

Ensuring Security

Security is a critical aspect of payment solutions, ensuring data privacy and protection. Techniques like encryption, stringent access controls, and privacy-by-design principles safeguard sensitive information.

Fraud prevention is another significant concern, with real-time monitoring and advanced AI fraud management tools playing a crucial role. Preventing unauthorized access through robust security measures, including biometric authentication, is essential.

A case study on security concerns in mobile wallet adoption, referencing TrustDecision, underscores the importance of these measures.

Mobile wallets, while convenient, require robust security protocols to protect user data from potential threats. By implementing advanced security features, retailers can ensure that customer information remains secure, thus maintaining trust and confidence in their payment systems.

Balancing Convenience and Security

Finding the right balance between convenience and security is a delicate task. Enhancing user experience often requires sophisticated security protocols that do not hinder usability. Advanced authentication measures like biometrics, behavioral biometrics, and tokenization can enhance security without compromising convenience.

Educating users through security awareness campaigns, in-app guidance, and simulated scenarios is equally important.

For instance, using tokenization in recurring payments enhances security by replacing sensitive information with unique tokens, while maintaining a seamless user experience. This approach ensures that security measures are robust yet unobtrusive, providing a secure and convenient payment environment.

Cost Considerations

The cost implications of different payment methods are a significant concern for retailers. Managing transaction fees and reducing overall costs is crucial for maintaining profitability.

Leveraging multiple payment gateways can minimize downtime and risk, ensuring that transactions are processed efficiently. Virtual terminals can also help reduce costs by enabling remote transactions without the need for physical infrastructure. A

By selecting cost-effective payment solutions and negotiating favorable terms with payment providers, retailers can optimize their payment processes.

Using virtual terminals can reduce overhead costs associated with maintaining physical POS systems, further enhancing cost efficiency.

Best Practices for Payment Solutions in Retail

Implementing best practices in payment solutions is vital for maintaining security and efficiency in retail operations. This involves several key strategies:

Strong Authentication Methods:

- PINs: Personal Identification Numbers (PINs) are a basic yet effective form of security, requiring users to enter a unique code to authorize transactions.

- Biometrics: Biometric authentication, such as fingerprint scanning or facial recognition, offers a high level of security by ensuring that only the authorized individual can access the payment system.

- Two-Factor Authentication (2FA): This adds an extra layer of security by requiring two forms of verification, such as a password and a temporary code sent to a mobile device.

Regular Monitoring and Real-Time Alerts:

Continuous monitoring of transactions helps to identify and mitigate fraudulent activities quickly.

Real-time alerts notify both the retailer and the customer of any suspicious transactions, allowing for immediate action to prevent potential fraud.

Choosing Reputable Providers

Partnering with providers that prioritize security ensures that the payment solutions implemented are reliable and secure. Reputable providers often have advanced security measures in place, reducing the risk of data breaches and other security threats.

Staying Up-to-Date with Technology and Security Practices

The landscape of payment technology and security is constantly evolving. Retailers must stay informed about the latest advancements and incorporate them into their payment systems. This includes adopting new security protocols and updating software to protect against emerging threats.

Education and Awareness

Educating both employees and customers on best practices for security is crucial. This includes training employees on how to handle transactions securely and informing customers about the importance of protecting their payment information.

Security awareness campaigns, in-app guidance, and simulated scenarios can help reinforce these practices.

Future Trends in Payment Solutions

The future of payment solutions is shaped by emerging technologies and trends. Artificial intelligence (AI) and machine learning are revolutionizing security, offering advanced fraud detection and prevention capabilities.

New technologies, such as voice-activated payments, QR codes, and cryptocurrency, are transforming how transactions are conducted.

Biometric technology continues to enhance security and convenience, providing secure and user-friendly authentication methods. The evolving landscape of global payments requires retailers to stay informed and adaptable.

By embracing these trends and integrating innovative solutions like virtual terminals, retailers can offer secure, convenient, and cost-effective options. Staying ahead of these trends ensures that retailers can meet the changing demands of customers and maintain a competitive edge.

The Bottom Line

Balancing cost, convenience, and security in payment solutions is crucial for retail success. By adopting innovative technologies and best practices, retailers can provide secure, efficient, and user-friendly payment options that meet customer needs.

Imagup General Magazine 2024

Imagup General Magazine 2024