Dividend-paying investments have taken center stage as markets become increasingly volatile. Investors are shifting their focus to reliable income sources, and well-performing companies are leading the charge. This article explores the surge in income-focused equities, the factors driving their growth, and actionable advice for leveraging this trend.

Key Points:

- The appeal of income-focused equities in uncertain markets.

- Macroeconomic trends shaping investment decisions.

- Strategies to identify sustainable dividend payers.

- Common pitfalls and how to avoid them.

- Long-term value versus chasing unsustainable yields.

What Fuels the Popularity of Income-Focused Equities in 2024?

Economic conditions have created an ideal environment for investments with regular payouts. Factors like elevated interest rates, modest GDP growth, and persistent inflation have pushed investors to rethink their strategies. Stable income-generating options appear more attractive now than speculative choices.

Certain sectors stand out due to their ability to maintain profitability and consistent payouts. Utilities, consumer staples, and healthcare have become go-to choices. They are well-positioned to provide stability, even during market downturns. For a detailed look on best dividend stocks, check out TradingView.

Macroeconomic Forces Behind the Shift

Several economic indicators explain the growing preference for consistent income. Investors need to recognize these forces to make informed decisions.

Key Economic Drivers:

- Interest Rates: Elevated rates make fixed-income alternatives more appealing, but payout-paying equities offer both income and potential capital appreciation.

- Inflation: Rising costs reduce purchasing power, making steady returns from reliable companies more valuable.

- GDP Trends: Slow yet stable growth has made investors cautious, prompting a preference for safer investment options.

Understanding how these elements interact can guide a robust strategy. For instance, when inflation rises, companies with strong pricing power and reliable earnings become more valuable.

Identifying Strong Income-Generating Investments

Choosing the right investments requires research and patience. Not all high-yield opportunities are created equal, and some come with hidden risks.

Checklist for Strong Options:

- Consistency: Look at payout history over 5–10 years. Stability beats a single high payout.

- Payout Ratio: A ratio under 60% is often a sign of a healthy balance sheet.

- Earnings Growth: Companies with expanding profits can sustain or increase payouts.

- Sector Strength: Focus on industries known for stability, such as utilities or healthcare.

Avoiding Common Mistakes:

- Chasing high yields without considering sustainability.

- Ignoring balance sheet health or debt levels.

- Overlooking broader economic or industry-specific risks.

Best Performing Sectors for 2024

Sectors driving income-focused investments tend to share common traits. Stability, low volatility, and a track record of reliable payouts stand out. Here’s a breakdown of sectors with strong performance and why they excel:

1. Utilities

- Why They Succeed: Utilities provide essential services like electricity, water, and natural gas. These are non-discretionary needs, ensuring consistent revenue.

- Examples:

- NextEra Energy (NEE): A leader in renewable energy with a history of steady payouts.

- Duke Energy (DUK): A major electricity provider with reliable dividend growth.

- Key Metrics: High cash flow stability and regulated business models ensure sustainability.

2. Consumer Staples

- Why They Succeed: Producers of everyday goods, such as food and household products, remain profitable even during downturns.

- Examples:

- Procter & Gamble (PG): Known for products with strong brand loyalty and consistent earnings.

- Coca-Cola (KO): A global beverage leader with a long history of payouts.

- Key Metrics: Strong pricing power and stable demand for goods make this sector reliable for payouts.

3. Healthcare

- Why They Succeed: Healthcare companies provide products and services that are always in demand, making them recession-resistant.

- Examples:

- Johnson & Johnson (JNJ): A diversified healthcare giant with decades of consistent payouts.

- Pfizer (PFE): A pharmaceutical leader with solid cash flow from essential medications.

- Key Metrics: Strong R&D pipelines and global demand for health-related products ensure sustained revenue.

4. Industrials

- Why They Succeed: Companies in this sector often dominate niches like transportation and logistics, ensuring consistent performance.

- Examples:

- 3M (MMM): Known for diversified industrial products and steady payouts.

- Union Pacific (UNP): A railroad giant with strong cash flow and an established dividend policy.

- Key Metrics: Operational efficiency and global trade reliance drive consistent earnings.

5. Real Estate (REITs)

- Why They Succeed: Real Estate Investment Trusts (REITs) are legally required to distribute most of their earnings, making them top income sources.

- Examples:

- Realty Income (O): Known as “The Monthly Dividend Company” for its predictable payouts.

- Simon Property Group (SPG): A retail REIT benefiting from premium shopping centers.

- Key Metrics: High rental income and strong property valuations sustain payouts.

These sectors consistently perform well for income-focused investors. Choosing companies with a strong track record within these industries ensures long-term portfolio stability.

How to Manage Risks in a Dividend-Focused Portfolio

All investments carry risks. Prioritizing consistency and diversification can minimize losses while maximizing returns. Risk management becomes especially important when focusing on income.

Key Steps to Manage Risks:

- Diversification: Avoid concentrating investments in one sector or company. Spread them across industries.

- Reinvestment Plans: Consider reinvesting payouts for compounded growth.

- Economic Monitoring: Stay informed about changes in interest rates, inflation, and GDP trends.

Investors should also evaluate company-specific risks. A sudden industry shift or regulatory changes can hurt long-term payouts.

Long-Term Benefits of a Consistent Strategy

Short-term gains may tempt many, but the most reliable investors focus on sustainable value over time. Long-term benefits often outweigh short-term rewards, especially in income-based portfolios.

Why Long-Term Thinking Works:

- Compounding dividends can significantly grow wealth.

- Lower portfolio turnover reduces transaction costs.

- Stability provides peace of mind during turbulent markets.

Investors aiming for retirement or future goals benefit the most. Patience often outperforms risky, short-lived strategies.

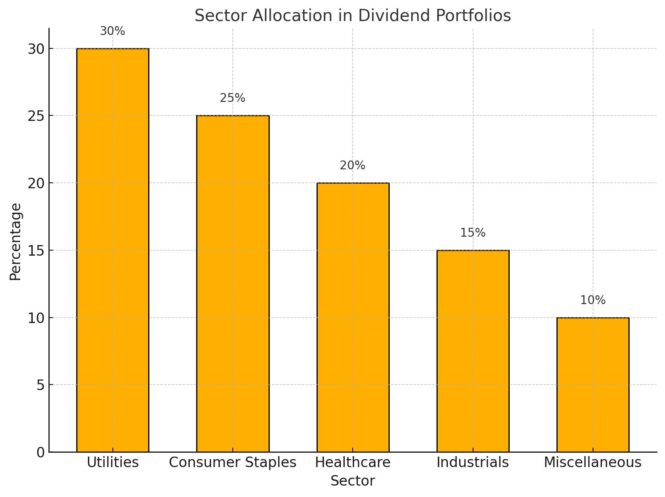

Sector Allocation in Dividend Portfolios

A histogram below illustrates common allocations in successful portfolios, highlighting the importance of sector diversification.

Here’s the histogram illustrating sector allocation in dividend portfolios, highlighting how successful portfolios distribute investments across stable industries. Let me know if you need any adjustments or additional data!

How to Start Building a Reliable Portfolio

Building a portfolio focused on consistent income begins with research and a clear strategy. Following a step-by-step approach simplifies the process.

Steps to Begin:

- Set Clear Goals: Define why income-focused investments fit your financial plan.

- Research Sectors: Focus on stable, recession-resistant industries.

- Evaluate Companies: Analyze payout ratios, earnings, and debt levels.

- Diversify: Invest across sectors and geographies for risk reduction.

- Monitor Regularly: Stay updated on macroeconomic trends and portfolio performance.

Practical Advice for New Investors

Beginners often overlook crucial aspects of income-focused strategies. Simple, actionable advice can set them on the right track.

Tips for Beginners:

- Avoid chasing unsustainable yields, even if they look attractive.

- Start with well-known companies offering reliable payouts.

- Consult experienced investors or financial advisors.

Consistency beats risky short-term decisions every time.

Tax Benefits of Dividend-Paying Investments

Investments with regular payouts often come with favorable tax treatments, making them even more attractive. Some jurisdictions offer lower tax rates on qualified payouts compared to ordinary income, allowing investors to retain a larger portion of their earnings.

For example, retirees often benefit from tax-advantaged accounts that shelter their income, ensuring a steady cash flow without heavy deductions. Always consult a tax advisor to understand the implications in your region and optimize your investment strategy.

The Role of Technology in Finding Opportunities

Technology has revolutionized how investors identify reliable income-generating companies. Platforms and tools offering advanced data analytics and real-time insights help investors spot trends, compare company metrics, and assess long-term viability.

Some tools use AI-driven algorithms to evaluate payout sustainability and risk, making the research process faster and more precise. Leveraging technology ensures informed decisions and improves the overall efficiency of portfolio management.

Conclusion

Income-focused investments offer an excellent way to generate steady returns, especially in uncertain markets. Understanding macroeconomic trends, focusing on sustainable payouts, and adopting a diversified strategy ensures long-term value. By carefully selecting investments and managing risks, investors can build portfolios that align with their financial goals.

Imagup General Magazine 2024

Imagup General Magazine 2024