In the thrilling world of trading, where fortunes can be made or lost in the blink of an eye, one rule stands out as a beacon of wisdom: the 1% Rule. This rule, often heralded by seasoned traders, is not just a guideline but a critical pillar of successful trading. In this blog post, we will unravel the mysteries behind the 1% Rule, delving into its significance in risk management, position sizing, and its real-life implications. By the end, you’ll be armed with the knowledge needed to trade like a pro, while protecting your hard-earned capital.

Introduction to the 1% Rule in Trading

The 1% Rule in trading is a fundamental principle that dictates the maximum amount of your trading capital that should be put at risk in a single trade. Simply put, it advises risking no more than 1% of your total trading capital on any given trade. This rule serves as a safeguard against devastating losses, ensuring that even a string of unfortunate trades won’t wipe out your entire account.

Explaining the Concept of Risk Management

Before delving deeper into this rule, it’s essential to grasp the concept of risk management, especially in the context of forex trading. Risk management in forex trading involves strategies and techniques aimed at preserving capital and minimizing losses in the highly volatile currency markets.

It’s the art of balancing the potential for profit with the inevitability of threat. Without effective risk management, forex traders are akin to tightrope walkers without a safety net, exposed to the abyss of financial ruin. In such a fast-paced and unpredictable market, it becomes even more critical, serving as a lifeline for traders navigating the turbulent waters of forex trading.

Importance of Managing Risk Effectively in Trading

The importance of effective management cannot be overstated. In the world of trading, where volatility and uncertainty are constants, preserving capital is paramount. A trader’s ability to survive and thrive depends on their knack for protecting what they have, even more so than on making big profits. Risk management is the shield that guards against the unpredictable nature of the markets.

Understanding Position Sizing and Its Role

Position sizing is the cornerstone of prudent management in trading. It’s the process of determining the appropriate quantity of shares or contracts to trade in a given position. This crucial step plays a pivotal role in implementing it effectively.

The amount of capital at stake in a transaction is directly influenced by the size of the position. You may prevent any single deal from jeopardizing your whole portfolio by properly adjusting your position size. You can delicately establish a balance between capital preservation and possible profit.

Moreover, position sizing is not a one-size-fits-all concept; it should be tailored to your threat tolerance, trading strategy, and the volatility of the asset you’re trading. A well-calibrated position size can be the difference between steady, sustainable growth and catastrophic losses in the world of trading.

Implementing the 1% Rule for Capital Protection

Now, let’s delve into how the 1% Rule works in practice. Imagine you have a trading account with $10,000. Applying it means that you should never bet more than $100 (1% of $10,000) on any single trade. This discipline forces you to set stop-loss orders that limit potential losses to this predetermined amount. By adhering to this rule, you ensure that no single trade can inflict a devastating blow to your capital.

Real-Life Examples of Risk Management Gone Wrong

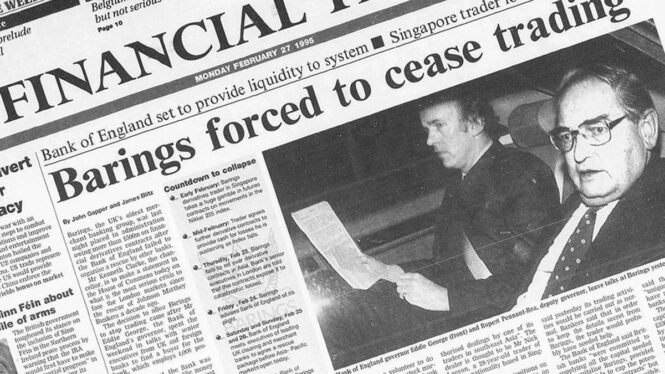

To highlight the importance and risk management, let’s look at some real-life examples of traders who disregarded these principles. There are countless stories of traders who bet too much on a single trade, hoping for a windfall, only to suffer catastrophic losses. Such tales underscore the perils of neglecting risk management and its value.

One infamous case is that of Nick Leeson, whose unchecked risk-taking led to the downfall of Barings Bank in 1995. Leeson’s massive bets on the futures market, without adequate management, resulted in losses exceeding £800 million, bankrupting the venerable institution.

Benefits of Disciplined Risk Management in Trading

Disciplined risk management, as exemplified by the 1% Rule, offers a multitude of benefits. Firstly, it safeguards your capital, ensuring you can live to trade another day. It also provides psychological comfort, reducing the emotional toll of trading. When you know that no single trade can ruin you, you can approach dealing with a clearer mind.

Additionally, effective management allows for consistent, sustainable growth. By avoiding substantial losses, you can compound your gains over time, leading to long-term success in the markets.

Common Misconceptions

Misconceptions often lead traders astray. Some believe it’s too conservative and hampers their profit potential. However, it’s essential to understand that it is not about maximizing profits in a single trade but about preserving capital and longevity in trading. It’s a strategy that prioritizes the long game over short-term gains.

Strategies for Adapting the Rule to Different Markets

While it is a powerful tool, it’s not a one-size-fits-all solution. Different markets and dealing styles require adjustments. For instance, in highly volatile markets, such as cryptocurrencies, you might opt for a smaller risk percentage, like 0.5%, to account for the heightened risk. Conversely, in less volatile markets, you might be more flexible with the rule.

Tools and Resources to Aid in Risk Management

In the digital age, traders have a plethora of tools and resources at their disposal to aid in risk management. Trading platforms often provide risk calculators that help determine position sizes based on this rule. Additionally, there are specialized software and mobile apps designed to monitor and manage risk automatically.

Educational resources, books, and courses are also invaluable for honing your risk management skills. The more you understand and practice risk management, the better equipped you’ll be to navigate the turbulent waters of trading.

Conclusion: Empowering Traders to Trade Like Pros

In conclusion, the 1% Rule in trading is not a mere suggestion but a fundamental principle that underpins successful dealing. It’s a beacon of discipline in a world of uncertainty, providing traders with the means to protect their capital and thrive in the long run.

By understanding the importance of risk management, position sizing, and the 1% Rule, you can empower yourself to trade like a pro. Remember, in trading, survival and consistent growth are the hallmarks of success, and the 1% Rule is your trusted companion on this journey. If you liked this topic, you may want to check our article on swing trading and see why could that career be your key to freedom.

Imagup General Magazine 2024

Imagup General Magazine 2024