In tough economic times, it’s especially important to be mindful of your finances. As the future grows uncertain and a potential recession looms on the horizon, now is the time to take stock of your savings strategies for better financial security in 2024 and beyond! This blog post will break down how best you can prepare yourself – read up here for essential steps to help save money during trying times.

Deleverage Before a Downturn

One of the most important steps you can take before a recession hits is to deleverage your finances. This means reducing your debt as much as possible so that you’re not overburdened when the economy takes a downturn.

This means paying down your mortgage, student loans, and credit cards. It also means avoiding taking on new debt so that you don’t get further in the hole when things get tough. By reducing your debt burden now, you’ll be better positioned to weather an economic downturn later.

Focus on Decision Making

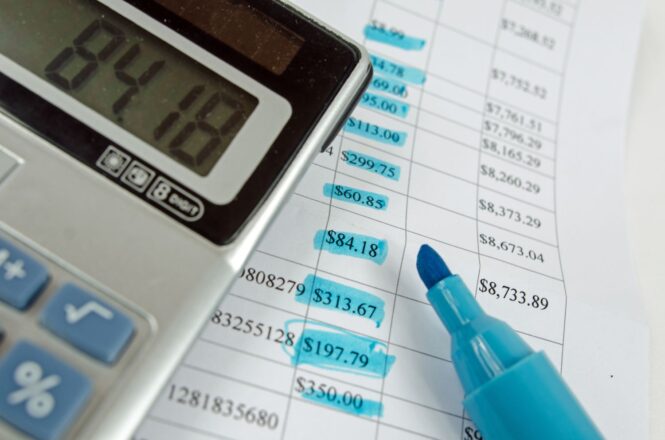

When navigating a recession, you must make intelligent decisions about where your money goes. Start by developing a basic understanding of how you are spending your money and building a budget.

To build a budget, determine your total household income and subtract all necessary expenses such as rent or mortgage payments, utilities, food costs, etc.

Once you know how much money is left over each month after paying for essentials, decide what percentage should go towards savings and investments. This will help ensure you can save enough money during the recession to stay financially secure afterward.

Look Beyond Layoffs

It’s easy to assume that layoffs are inevitable during an economic downturn, but there are other ways companies can reduce costs without letting people go.

For example, some companies may reduce hours or offer unpaid leave instead of layoffs to cut costs while still keeping their employees employed during the recession.

Additionally, many companies may choose to invest in technology such as automation or artificial intelligence which can help them become more efficient with fewer resources required from human labor.

Reduce Expenses

As a homeowner, one of the best ways to cut expenses is by making small changes that add up over time. For example, you can switch to energy-efficient light bulbs, unplug electronics when not in use and set your thermostat higher (or lower) during the summer or winter. You can also consider turning off lights and running computers on standby until they’re needed for work tasks.

Similarly, the occasional repairs and fixing around your house can add up over time. The best solution is investing in a home warranty that covers all repairs, including plumbing and heating. This can save you hundreds of dollars monthly in repairs and maintenance costs. The best thing about home warranties is that they’re affordable.

If you’re interested in learning more about home warranties, Cinch is a great place to start. They offer affordable coverage options to help you save on repairs and maintenance costs. Plus, Cinch home warranty reviews are overwhelmingly positive.

Don’t Be Afraid Of A Bear Market

It’s natural for investors to feel anxious when stock markets start falling, but it’s important not to panic sell during these times as this could result in losses rather than gains for investors who don’t know what they’re doing.

Instead of selling off stocks at low prices due to fear or panic, try researching stocks before investing so that you know what kind of returns they typically provide over time.

Additionally, diversifying your portfolio across different asset classes, such as bonds, commodities, real estate, etc., will help protect against market volatility losses.

Don’t Try To Time The Market

Timing the stock market is notoriously difficult even for experienced investors, so trying to do so without the proper knowledge could cost you more than it earns.

Instead, focus on long-term investments such as index funds which track broad market indices like S&P 500 or Nasdaq Composite Index. These investments tend to outperform actively managed funds over time since they don’t require constant monitoring and rebalancing like actively managed funds do.

Maintain A Savings Account For Emergencies

Bad days don’t just happen in the stock market. If you’re unprepared for a financial emergency, it could throw off your long-term goals.

Having emergency savings set aside is always essential, especially during economic uncertainty when job security might be uncertain. Aim to save at least six months’ worth of living expenses in case something unexpected happens, like a job loss or medical emergency.

This way, if something does happen unexpectedly, you won’t have to worry about finding extra money cover expenses until the situation stabilizes again.

Invest in Your Skills and Education

During a recession, it’s crucial to invest in yourself and your skill set. By enhancing your education and professional skills, you increase your marketability and value in the workforce. This can help you maintain job security, switch careers, or even start a business.

Here are a few ways to invest in your skills and education:

- Online courses: Take advantage of the vast number of online courses available in various fields, from programming to project management. Many of these courses are affordable or even free.

- Certifications: Acquiring relevant certifications in your industry can make you stand out from the competition and showcase your expertise.

- Networking: Attend industry events, join professional associations, and use social media to expand your professional network. This can lead to new opportunities and help you stay informed about industry trends.

- Soft skills: Don’t forget to hone your soft skills, such as communication, teamwork, and problem-solving. These skills are often just as important as technical abilities and can make a significant difference in your career.

Conclusion

Navigating a recession may seem daunting, but with careful planning and strategic decision-making, you can save money and stay financially secure.

Focus on deleveraging, smart decision-making, looking beyond layoffs, reducing expenses, investing wisely, and maintaining an emergency fund. Don’t forget to invest in your skills and education to keep yourself marketable and resilient in the face of economic challenges.

By following these steps, you’ll be well-prepared to weather any financial storm that comes your way.

Imagup General Magazine 2024

Imagup General Magazine 2024