Bitcoin has been taking the world by storm with its recent value hikes. What started out as a currency worth a few measly cents in 2009, is now worth almost as much as $60,000 in today’s market. The cryptocurrency market has only flourished in the past few years gaining monumental amounts of new value. Even during the pandemic when the global economy and stock market crashed, cryptocurrency not only survived but actually increased in value.

Crypto analysts say that cryptocurrency is here to stay and is only going to increase in value in the near future. As such, the cryptocurrency world has seen a plethora of users join its investing ranks to insure some money in today’s uncertain economy. And to meet the investor’s rising demands, many people have also started bitcoin mining on their rigs to generate profits for themselves. According to bitcoineranew.com, the sooner you jump on the cryptocurrency bandwagon, the sooner you’ll ensure amazing returns for your future self.

However, there is one important phenomenon that both investors and miners ought to know before they enter the world of cryptocurrency. That phenomenon is called bitcoin halving and it’s one of the most important concepts every cryptocurrency investor and miner should know. That is because when each of the bitcoin halvings occurs, the value of bitcoin goes through a very volatile and dramatic phase.

If you are unaware of bitcoin halving or are aware but only have surface knowledge of it, then we strongly recommend reading this article to the end to understand what bitcoin halving is and how it impacts the cryptocurrency market.

What exactly is bitcoin halving?

To clear up any residue of confusion you might get while reading the article, let’s start with the basics first. Basically, a bitcoin block is a file that stores 1MB worth of bitcoin transactions. These blocks are then added to the bitcoin blockchain, a network of bitcoin blocks. What a miner does is mine these blocks by solving complex mathematical puzzles and generate keys called “hash” keys that lock the block when it’s added to the blockchain.

Mining is quite a power-intensive job. In fact, the annual energy consumption for mining bitcoin is equivalent to the energy consumption of the entire country of Sweden per year. That’s why no miner would do any kind of bitcoin mining if there wasn’t anything in it for him. For each block miners mine, they are awarded a certain amount of bitcoin as their well-deserved reward.

If you ever studied even the bare basics of economics, you must be well aware of the term “inflation”. You’d be surprised to know that even though bitcoin is not really a real currency, since it’s entirely digital, it, too, has its own form of inflation. This inflation is called “bitcoin halving”. It is given such a name because whenever it occurs, it halves the amount of bitcoin you get after mining each bitcoin block.

Bitcoin halving does not occur randomly. Bitcoin’s founder, Satoshi, designed it in such a way that it would only happen when each set of 210,000 blocks, out of bitcoin’s maximum capacity of 21 million blocks, are mined. This generally occurs every four years, with three halvings already done.

Why do bitcoin halvings happen?

When a commodity gets too commonplace and starts losing its value gradually, supply is decreased and inflation is encouraged so that the commodity isn’t depleted prematurely. Bitcoin, too, is a commodity. The bitcoin blockchain network can only support up to a maximum of 21 million bitcoins. This is a hard limit for bitcoin generation beyond which no bitcoins can be mined.

As more and more blocks are mined every day, the number of bitcoins in circulation for market use also increases. Already the number of bitcoins in circulation is closing to 19 million today and the market is inching closer to exhausting the supply. To prevent this from happening, bitcoin halvings happen. When bitcoin started out, each block gave about 50 bitcoins after mining.

After the first halving, the reward was decreased to 25. With each subsequent halving hereafter, the reward was halved and the most recent halving decreased the reward to 6.25 bitcoins per mined block. This way, bitcoin halving limits the circulation and supply of bitcoins to ensure the longevity of the cryptocurrency market.

The impact of bitcoin halving on the market.

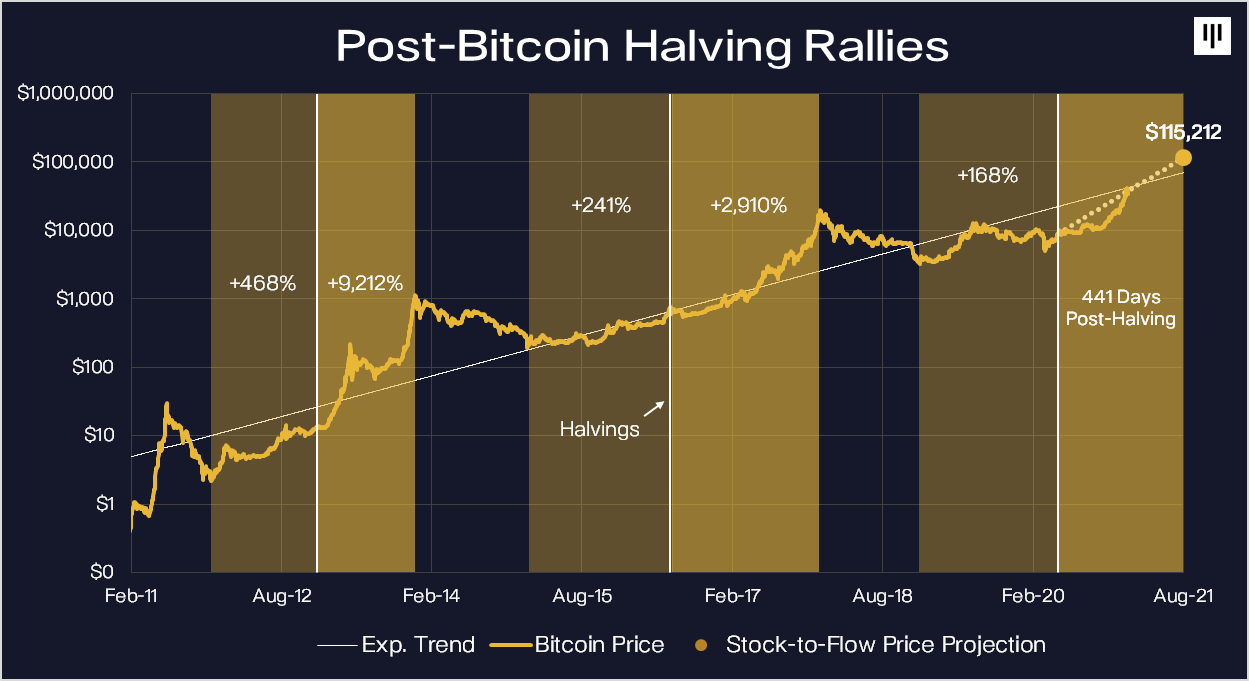

By now you might be wondering, if bitcoin halving halves the rewards miners get from mining a block, why would they continue mining when the halving happens? We’ll come to that answer very shortly when you first understand the impact bitcoin halving has on the market. When the event occurs, the market falls drastically in value as people start investing out of bitcoin because of its new value. However, that changes soon as people start investing back again and because of its new limited supply the value of bitcoin skyrockets in the course of a few months.

You wouldn’t find bitcoin halving occurring in a bear market. It’s always because the demand for bitcoin increases, that the supply is forced to halve itself with a bitcoin halving. Take the examples of all the halvings to date. The first halving occurred around 2012 when bitcoin’s price rose by a dollar. The halving occurred but soon regained its value by 100 times by the end of the year. A better example would be the most recent halving in 2024, where the value of bitcoin dropped as low as $10,000 but soon regained its form and hit a new value ceiling of $60,000 in the course of 8-9 months.

It’s exactly because of this price hike that miners are urged to mine bitcoin blocks, even if the rewards they get from mining are inherently way less than before. This way bitcoin miners can continue generating a healthy revenue for themselves and mine as many blocks as before. This will continue till the last reserves of bitcoin are depleted, after which they will be paid generous transaction fees by anyone who transacts in bitcoin.

Conclusion.

Bitcoin halving is an essential phenomenon when it comes to understanding the bitcoin market. However, it can be complicated too if not explained properly and we hope this article helped you clear all your doubts and confusion away. If it did, please consider following our website for regular updates as it will help us out immensely.

Imagup General Magazine 2024

Imagup General Magazine 2024