Bitcoin is one of the leading cryptocurrencies that has recently intrigued the public and encouraged many to think about investing. Digital currencies operate within a blockchain technology that is a publicly available decentralized digital book and provides insight into all cryptocurrency transactions. Decentralized character allows the independence of technology, which is an additional advantage. With the development of blockchain, interest in investing is increasing and many would like to become part of this exciting industry that can bring them many financial benefits. The attention of some of the most successful companies and investors is focused on the digital market precisely because of the belief that it will continue to expand and that it will last much longer than thought. This could be one of the most fun and profitable ways to experiment with new investments.

Bitcoin is traded within the blockchain platform, on which, in addition to cryptocurrencies, other values can be traded. Usethebitcoin.com suggests some ways to invest in this technology.

Once you decide to take this path, it’s important to be aware of the fact that the risk of loss always exists, and if you aren’t ready to bear it, you must enter the game with a smaller amount of money. The more benefits it can bring you, the more headaches it can give you if you don’t inquire in time about how to invest smartly in bitcoin technology. Here are some tips.

How to start investing in bitcoin?

The process of connecting to this digital network begins with registering for the exchange. Its role is to enable the purchase of cryptocurrency in cash. The exchange is a platform that can be accessed via the Internet and allows each user to buy and sell selected cryptocurrencies.

If you wish to purchase a larger amount of bitcoin, the system may require verification of your account.

CEX is a good idea because through it you can access some of the currently most popular cryptocurrencies such as Bitcoin, Ripple (XRP), Ethereum (ETH), and Stellar Lumens (XLM). Besides, it provides good conditions with a high daily limit of 20,000 US dollars.

The next step after buying bitcoin is to decide on whether you want to keep it on an exchange or transfer it to your personal wallet. Wallets are a personal item, to which only you have the key and in which you can store your bitcoins. In addition to the key, the wallets also have a public address and indicate that you’re the owner of what is inside. The public address and the key have their purpose, where the public address is used to obtain funds and the key to spend.

Start investing in digital assets

The first suggestion on how to become part of the digital world and start investing in bitcoin technology is investing in digital assets. In this way, you simply support the growth of bitcoin located on the blockchain platform and invest in digital bitcoin assets. Cryptocurrencies are the most well-known type of property and that’s why people most often decide to trade them.

The process isn’t difficult and consists of several steps. First, you need to open an account in cryptocurrency and register for the exchange. For example Coinbase or Gemini. After that, you can start buying bitcoin. Then put them in your personal wallet.

In addition to buying bitcoin, or some other cryptocurrencies available to you, there are other, lesser-known ways to make a smart investment. Other options such as trading gold, stocks, real estate, or art are also available on the blockchain platform.

As a novelty recently, tokenized securities have also appeared, which attract the attention of those interested in its blockchain version. Their advantage, in short, is reflected in faster transactions with lower costs and increased liquidity. It’s up to you to choose whether crypto commerce is the right thing for you or this traditional means of the modern blockchain version.

Investing in blockchain companies

In addition to buying tokens, you can invest in blockchain technology by directing investments in companies specializing in blockchain products and services. Unfortunately, you can’t rely on public blockchain because the possibilities are small. The chain of companies that are oriented towards this technology is still not big enough, and if this information doesn’t discourage you, you might be able to check out Hive Blockchain and Riot Blockchain.

The two most profitable ways of investing have stood out on the market – angel investing and crowdfunding.

The angel type includes the first people to fund a startup. In return, they receive compensation, which usually occurs in the form of capital. Many blockchain startups have liked this tactic. In case you decide to go this way, there are conditions that you need to meet and which are prescribed by the Securities and Exchange Commission. According to their requirements, you must have a net worth of more than a million dollars or an income of over 200,000 dollars in the last two years.

If these requirements are too much of a challenge for you, you can always turn to the crowdfunding option. Some platforms allow you to invest in a blockchain startup with significantly less start-up capital.

Market analysis

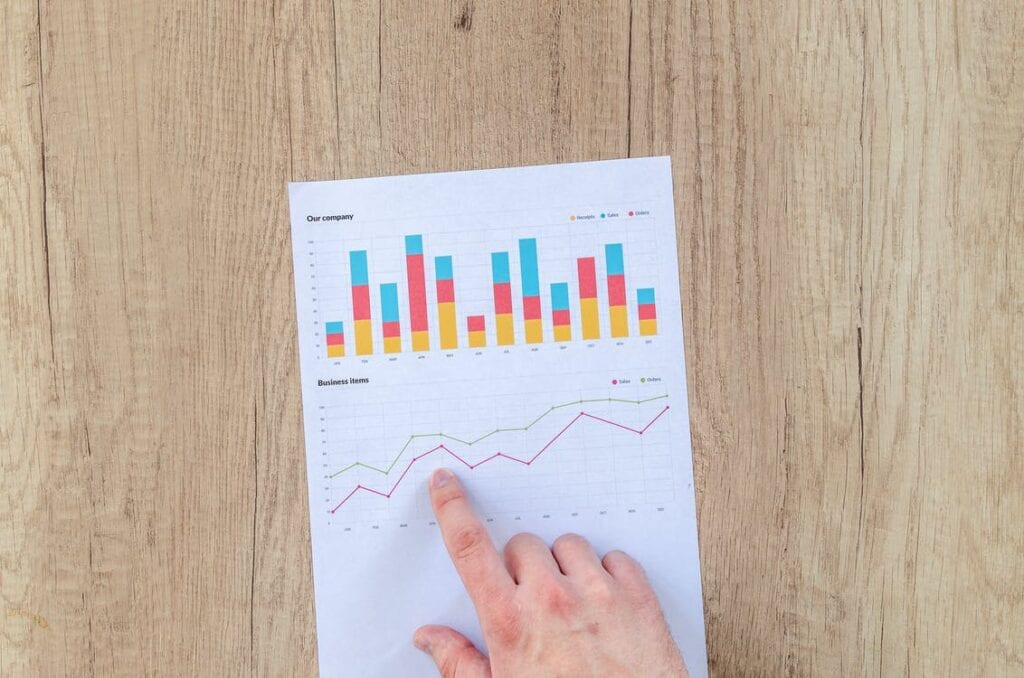

Once you are well informed about bitcoin and its advantages, as well as the way it works, it is inevitable to take a mandatory step, which is market analysis, which is necessary in this case. Monitoring market developments, and data that allows analysis of the past, present, and future data, will help you more easily decide when is the right time to take the necessary steps.

Investing in blockchain and bitcoin technology supports the expansion of the cryptocurrency network and its survival. The key to success is smart decisions made at the right time, and in that way, you’ll ensure that unpredictable changes in the market don’t surprise you.

The future of bitcoin as a digital currency seems bright to many. Before you decide to invest, get well informed about this, as well as about the blockchain platform and the opportunities it provides, to increase the chance of getting benefits and reduce the risk of unforeseen situations that can lead to financial collapse.

Imagup General Magazine 2024

Imagup General Magazine 2024