Buying a bike insurance policy can be overwhelming, given that there are plenty of options to choose from. Here are a few tips to help you choose the best plan at a discounted price.

With the onset of monsoon season, several brands announce various discounts, sales, and offers, and the insurance players to are fast catching up with the trend. As a customer, you may feel delighted hearing these words because it implies cost-saving. You can purchase the things you want without stretching your purse strings.

When it comes to buying insurance policies, discounts can make even the choosiest customers smile. Since bike insurance is a mandatory requirement by law, you can use the following tips to get an attractive discount on your insurance policy this monsoon.

1. Buy online

Today, with most insurance companies in India offering online services, most people prefer buying a policy online. Not only is buying a policy online quick and efficient, but it also guarantees savings in two ways. One, you can compare the different insurance companies’ different plans and choose the one with the most affordable premium. Two, many insurance companies offer discounts on premiums for online buyers. So, if you wish to buy a new two-wheeler insurance policy or renew your existing one, choose the online mode, and you can save a few bucks.

2. Purchase a long-term policy

One of the significant benefits of buying a long-term plan is that you can avoid the hassles of annual renewal and continue to get protection for a longer period. Also, insurance companies offer a discount of 10% to 15% on premiums for long-term bike insurance plans.

3. Claim the NCB

The insurance companies reward the policyholders who do not file for a claim during the policy period with NCB or No Claim Bonus upon renewal of the policy in the subsequent year. The bonus is usually in the form of a discount on the premium.

The discount rate offered varies from insurer to insurer, but it usually ranges from 5% to 10%, and it increases for each successive claim-free year. You can get up to a 50% discount on the HDFC Ergo two-wheeler insurance if you don’t file a claim for five consecutive years.

If you have accumulated bonus points, you can redeem the reward and get a discount on the insurance renewal. It is essentially a reward offered by the insurance company for being a responsible and safe driver.

4. Install security devices

When you file a claim for a damaged bike or stolen vehicle, it is a liability for the insurer. Hence, to discourage policyholders from filing a claim and encourage the safety of your bike, the insurance companies reward the policyholders who have installed advanced security devices like disc brake and an anti-theft system.

The company rewards you in the form of a discount on the premium. So, to get a discount on your policy purchase and ensure your safety while driving in the monsoon, you can enhance your bike’s safety features.

5. Use the driving records to your advantage

If you have a clean driving record and have never violated traffic laws or got involved in an accident, you can use this to your advantage and negotiate with the insurer to get a discount on the premium. Clean driving history reflects your credibility as a safe driver to the insurance company. The insurance company may reward you with a discount on the bike insurance premium.

6. Ask for loyalty benefits

If you hold a life insurance policy or a health insurance policy from a particular company, you can buy bike insurance from the same insurer. The significant advantage of buying multiple policies from the same company is that you are more likely to get rewarded for your loyalty in the form of a discount on the bike insurance premium.

7. Be decisive with choosing the add-ons

Buying an add-on cover may widen the scope of your regular policy’s coverage, but remember that additional protection comes with an additional cost. Often, many people tend to buy multiple add-ons, which may not be useful to them and end up paying a high premium.

To avoid this situation, you must be prudent with your choice of add-ons. Assess your needs well, and choose only a specific add-on that you think is useful to you. If you have multiple add-ons, when you renew the policy, you can drop them, and your premium will automatically reduce.

8. Ask for an age-based discount

Some companies provide an age-based discount to policy buyers. Generally, policy buyers aged less than 25 years are considered to be rash drivers. Since the insurers carry a high risk, they charge a higher premium for such policy buyers.

In contrast, people aged between 35-60 years are considered to be responsible riders. If you fall in the said age bracket, you can ask the insurer for an age-related discount. Remember, you must premium for a full year, and even if you get a 5% discount, it can help you save a significant amount in the long-run.

9. Renew your policy on time

If you fail to renew your bike insurance policy within the due date, you not only risk losing all the accumulated benefits, but you also risk policy termination. You may have to pay a higher premium when you renew your policy or purchase a new policy subsequently.

It is, therefore, important to renew your policy to avoid discontinuation of the policy. Most companies have a simple online renewal process.

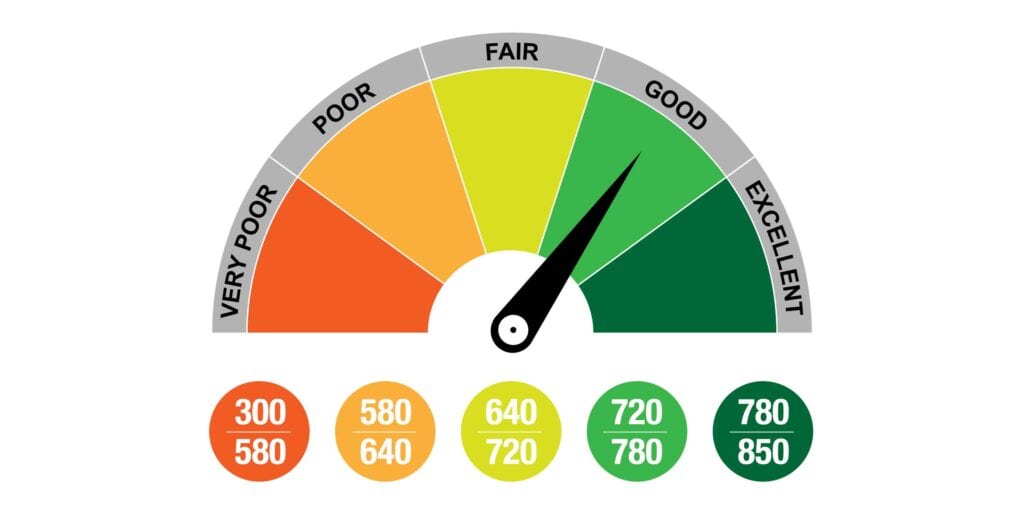

10. Maintain a good credit score

Lastly, if you have a good credit score, you can get a discount on the insurance premium. Before you purchase bike insurance, review your credit score and if your score is low, take steps to improve it.

Now that you are aware of the different ways to get a discount on bike insurance, use them to your advantage. Before you sign the policy papers, make sure that you read the terms and conditions carefully and be aware of the inclusions, exclusions, claim settlement terms, etc. to avoid any hassles while filing a claim.

Imagup General Magazine 2024

Imagup General Magazine 2024