The development of Internet technology allowed people to make money in different ways. Fortunately, more and more people are using the opportunity they got. Online trading is one of the methods that people prefer to use. However, the industry itself is complex and it takes time until you completely understand it. Because of that, a huge number of people decide on collaborating with online brokers.

Choosing the best online broker on the Internet is not an easy task. You can find a huge number of them by basic Google research. At first, glance, cooperating with each one will seem like a perfect solution. However, not all of them are equally good.

Things to Consider When Choosing the Best Online Broker

The entire process of finding the best online broker lasts a bit longer than you might think. You should go through different stages before choosing the one that matches your requirements. Let’s see together which things you should consider.

Costs

Fees that you will potentially have might not be the most important factor. However, we know they are important to beginners. Because of that, it would be important to put them into consideration.

It is hard to say how high the fees for trades are going to be. Logically, they are different from one place to another. However, if the fees are higher, it doesn’t necessarily mean that you should avoid collaborating with a particular online broker.

The smartest decision of all would be to check the broker’s fee schedule as a whole. You might get the chance to find brokers with rock-bottom trade fees. Yet, this might not bring you long-term benefits. It might happen that you will need to overpay for some other fees.

Customer Service

Making certain mistakes as a beginner is not something unusual. You might get stuck when placing a trade order. Yet, this is not going to be a huge problem if the broker has good customer support. They should be available for you to correct all the mistakes promptly. If their customer support is not quality enough, you might suffer a big financial loss.

The most professional online brokers will always offer a couple of ways of communication. For example, three basic options of communication are live chats, telephone, and email. Not having these three options might be a red flag for you.

Matchable with Your Investment Strategy

You might be a beginner who is looking for ways to earn money. However, you surely have certain plans for your trading. Because of that, you should chase those that are completely matchable with your investment strategy. It would make no sense to pick those that are focused on some trading options that you do not want to use.

Reviews of Previous Customers

As we said in the beginning, you will find dozens on them by basic Google research. In that case, we should all look a social proof that picking the current broker would be a smart decision. Because of that, you should read the reviews of previous traders/investors and check how this or that broker provides Forex services. If most of the reviews are positive, that could be a good thing for you. On the other hand, if most of the reviews are negative, there is no need to collaborate with such an online broker.

Still, you can also use Google to find out more about your potential client. Many websites analyze different online brokers and share independent reviews. It is important to invest additional time and effort to find those reviews and confirm to yourself that you are not making a mistake.

Best Online Brokers on the Internet

We highlighted the most important factors that you should consider before picking the online broker. However, we are sure that you would want to get some additional fees. By checking out the list below, you will be able to find suitable options due to your personal preferences. Let’s find them out together.

Exness

Exness is a popular Forex broker specializing in the international stock markets. Today, the broker offers a wide range of opportunities to trade with more than 120 financial instruments on the most favorable trading conditions. The company has an ISO certificate as well as a CySEC license. Thanks to the Exness broker, you can trade with different international currencies and types of metals in Forex. In addition, forex and CDF can be used for trading purposes. This is where reliable and trustworthy trading platforms such as MetaTrader4 and MetaTrader5 can be accessed. Visit tradersunion.com for more information.

Pros:

- Automatic withdrawal of funds from your personal account;

- Attractive trading policies;

- Free VPS-service;

- Profitable partner cooperation project;

- Access to the interbank market;

- Efficient customer support in 15 languages.

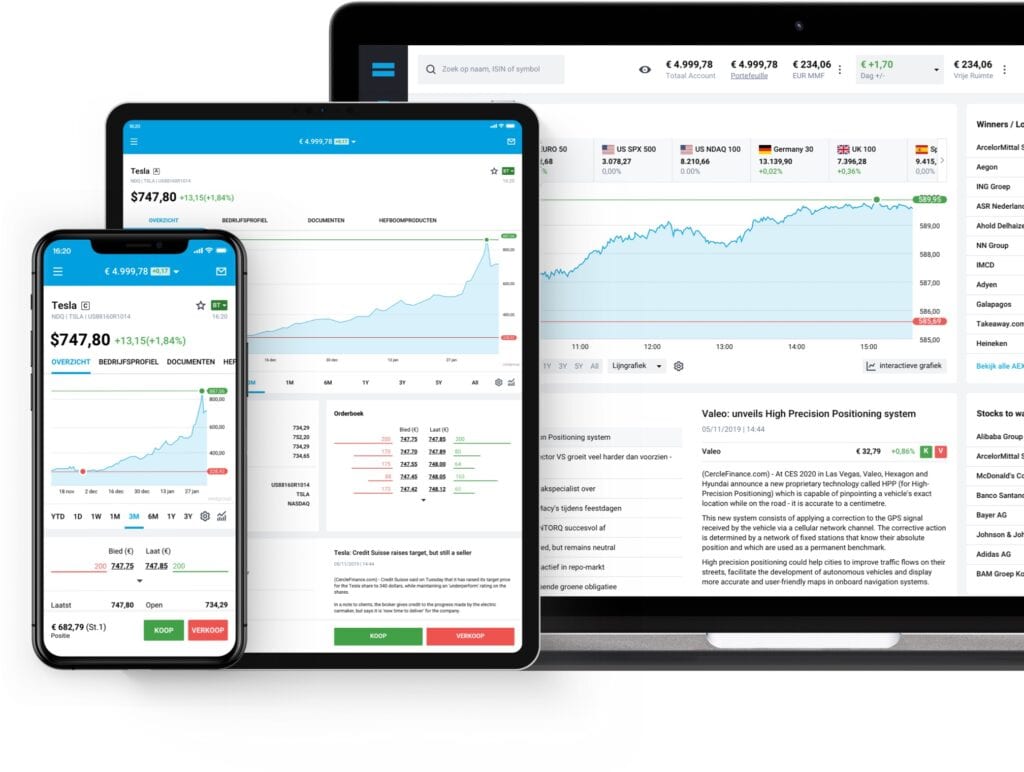

DEGIRO

DEGIRO is considered to be the fastest Forex broker. It has gained a positive reputation due to its low stock commissions, global stock exchange coverage, and the top-notch services it offers. DEGIRO is a reasonable trading option if you need a simple platform featuring low expenses. In fact, this broker is considerably cheaper compared to other European companies. DEGIRO is marked with a simple and fast registration procedure, while the price policy is based on relatively low costs. At the same time, you can only deposit and withdraw money via a bank transaction, which causes some difficulties for traders and investors. Generally, DEGIRO is a decent online broker to try your luck with. With no minimum deposit involved, you should be encouraged to take action.

Pros:

- Some of the lowest fees on the market;

- Managed by multiple top-tier regulators;

- Easy navigation of the website and mobile application.

FXTM

ForexTime (FXTM) is an online broker dealing with foreign exchange. With more than 50 currency pairs such as major, minor, and exotic pairs, FXTM enables the leverage level of 1000:1. Meanwhile, spreads remain competitive across all resources, while 24-hour trading is operating throughout the week. FXTM has its licenses issued by the authoritative bodies in Cyprus such as the International Financial Services Commission (IFSC) and Cyprus Securities and Exchange Commission.

Pros:

- Presence of a free demo account;

- More than 250 instruments such as Forex, commodities, shares, indices and cryptocurrency CFDs for trading purposes;

- Competitive spreads;

- MetaTrader 4 and MetaTrader 5 platform support.

XM Group

XM Group is an online broker keeping customers’ funds on the special segregated accounts. Also, there is a special negative balance protection mechanism allowing customers not to worry about financial losses. The trading routine is processed via popular trading platforms such as MetaTrader and WebTrader. XM Group knows how to manage all the orders on time and at no requotes. According to the customers’ reviews, you will make sure of the positive reputation of XM Group. Generally, the goal of this online broker is to stick to the latest financial trends and provide tight spreads, which are monitored by well-reputed regulators like IFSC, ASIC, and CySEC.

Pros:

- Multiple educational materials, seminars, and webinars aiming to teach customers on the specificity of online trading;

- Licenses issued by the reputed authorities such as FCA, CySec, and ASIC;

- Multiple tradeable tools like Forex, Stocks, Precious Metals, Energy, Cryptocurrencies, and Equity Indices markets;

- Negative balance protection.

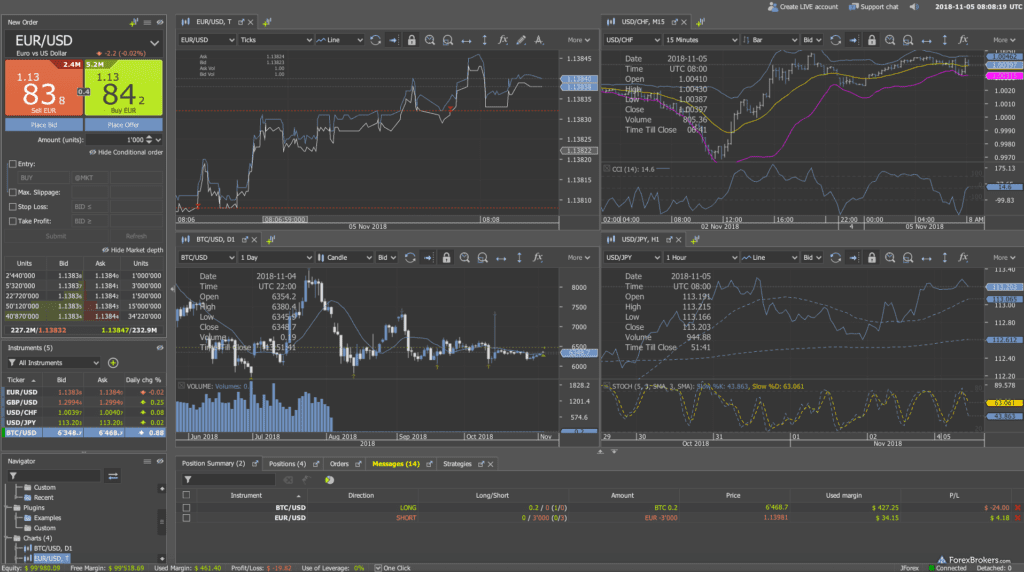

Dukascopy

Dukascopy is a famous Forex broker equipped with advanced trading tools and market research algorithm. Dukascopy has a Swiss banking license issued by the Swiss Financial Market Supervisory Authority (FINMA). Thanks to a smart solution for highly experienced traders and investors, Forex ECN trading is enabled via the Swiss FX Marketplace (SWFX), CFD trading on Stocks, Indices, Commodities, and Cryptocurrencies, as well as Binaries.

Pros:

- Trusted and well-administered by authoritative bodies;

- Automated trading with JForex platform and MT4 Support;

- Multiple market research instructions, advanced charting, and promotions

- Tight spreads and competitive fees.

Final Word

With many options available on the trading market, you will be able to find an online broker addressing your financial expectations and personal needs. As soon as you make your investing goals, style, and key needs transparent, you will be able to make the right choice. Eventually, you will be able to trade and invest whenever you feel like it.

Imagup General Magazine 2024

Imagup General Magazine 2024